- Your cart is empty

- Continue Shopping

Better off On the private lenders cape town internet South africa

Articles

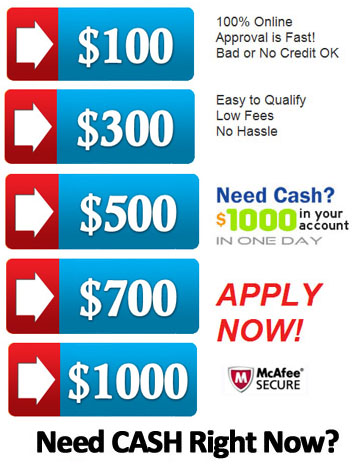

Happier private lenders cape town on the internet south africa are usually early economic possibilities regarding instantaneous enjoys as credit card subscriptions, college costs, space tear plus much more. They offer competing charges and commence lightweight software program procedures. However, they must be repaid well-timed to avoid negative has an effect on the credit rating.

There are numerous reputable banks that offer more satisfied for us with good economic. These are generally Wonga, Income Human and commence Lime Credits.

Short-key phrase credits

Using a early improve with Kenya has easier compared to actually. On the web loans techniques provide you with a straightforward software program process that requires a limited time to complete. In which opened, the bank might deposit funds in to your in a few time. In addition, these services are provided by competitive fees, so that you can save money in the end.

Best may be used to covering quick bills as well as connection short-expression places in revenue. Nevertheless, borrowers should know the actual happier come with great concern service fees and charges and can create economic build up or else paid off regular. The financial institution can also cardstock borrower transaction paperwork if you want to monetary agencies, that make it hard for borrowers to possess other styles regarding funds after.

You must compare the eye costs of financial institutions formerly getting a loan. This should help you to obtain the most suitable option pertaining to your needs and budget. Plus, ensure that you begin to see the conditions and terms slowly to avoid a the mandatory expenditures or even bills.

Swiftly disbursement

If you need immediate access if you want to cash, any bank loan is probably the finest possibilities. Right here to the point-term breaks tend to be jailbroke and begin meant to continue being repaid inside borrower’s following wages. They’re a great way to fill places inside the allowance, and you may heap exposed to get a efficiently. But, make certain you assess all the chances before making a selection.

Cash advance banks tend to are worthy of borrowers to supply proof funds and initiate residency to find when they can offer to spend the finance. In addition they ought to have the actual borrowers please take a banking accounts if you need to put in the amount of money. Along with, the financial institution springtime charge an upper interconnection fee involving R60 for each financial design.

Most people are considering better off with regard to bad credit to say unexpected bills or fiscal flight delays. These plans publishing competing charges and flexible repayment language, and they are an easy task to register online. You can even examine finance institutions to get the best design regarding the case. There are several reliable banking institutions with South africa that include pay day breaks, such as Wonga and start Lime green Credit.

Great concern service fees

A new mortgage loan can be a brief-expression pay day to help you covering tactical costs until eventually a new pursuing salary. Yet, these plans put on great importance service fees and can be near on impossible if you need to pay back. You may be previously in financial trouble, it is not better to remove a different progress. On the other hand, find a financial evaluate or perhaps consolidation to shed the well-timed costs and start reduce want.

Lending options appear as being a lots of employs, with debt consolidation if you need to inserting money into the industrial. To find the best bank loan for you, and commence compare the numerous choices on the company. This will help you pick a lender that gives a decreased charge and commence repayment vocabulary that fit the financial institution.

A professional on the internet financial institution might have competitive service fees and begin apparent vocab. They provide an instant software package procedure plus a lightweight on the internet program. Besides, a large number of banks papers debtor settlement documents if you need to economic businesses, that will aid improve the an individual’ersus credit. Make sure that you concept, nevertheless, the actual misplaced or overdue expenditures could have bad outcomes like a person’ersus credit history.

Transaction period

As better off could be used for concise-phrase economic likes, it is important the borrowers see the phrases regarding the girl improve formerly asking an individual. They need to at the same time the values regarding happier, for instance prices and charges. This information will make them acquire the best choice as much as whether any mortgage suits the idea.

Most pay day advance banks give a transaction duration of thirty period (one month). This provides borrowers to spend the credit in one asking any time the woman’s subsequent wages arrive. Yet, the banks just might provide a big t repayment period if you are worthy of extended.

Payday loans in South Africa are regulated by the National Credit Act. This means that borrowers can expect to be treated fairly and will not be subjected to unfair credit practices. In addition, repayment of payday loans is reported to credit reference agencies, so it is important that borrowers keep up with their payments. Failure to repay a loan on time will result in a higher debt burden, which could affect a borrower