- Your cart is empty

- Continue Shopping

Financial products kwalaflo loans Pertaining to Individually

Content articles

Financial institutions think about a consumer’utes income and find out if they can pay out her financial. They desire proof funds, which may possess income stubs, income tax and commence deposit assertions.

However, being a self-used helps it be hard to confirm regular income. This can be complicated regarding improve acceptance. The good news is, we’ve financial institutions that will make use of do it yourself-applied borrowers.

one. Rules

Financial products is usually an shining way to obtain match other financial wants, including managing financial as well as cash main strategies. Many loans need a consistent cash flow to spend spinal column the loan, finance institutions instead the applicant’ersus credit history and other issues when coming up with a financing choice. Usually, salaried individuals are in a position to demonstrate your ex funds by providing consent while pay out stubs and start P-2 styles within the computer software procedure. Nevertheless, this may be considered a query for individuals who act as writers or even have their organizations since the girl income can vary greatly regular.

Fortunately, today we have thousands of progress possibilities in case you are self-utilized. If you want to be eligible for a private progress, the most important thing with regard to do it yourself-applied one to put on secure money which can support the girl well-timed costs and start show their ability to pay the credit. They can must also enter various other money proof linens, for instance put in statements or perhaps money and begin loss phrases to their professional.

Each kwalaflo loans time a consumer is not able to key in vintage proof money, that they try to be entitled to an exclusive improve having a cosigner or additional sources of fiscal. Right here options consist of a good value of stake in business or perhaps any cosigner’utes solutions or even earnings. Charging opened up like a bank loan if you are separately can be more difficult compared to when you are salaried, however it is but most likely to obtain a standard bank that will signal a advance software.

2. Expenditures

In the event you’re also personal-used and wish a little bit more income, an exclusive move forward may be the entirely way for anyone. As a company move forward is actually better with regard to higher expenditures, loans can fix startup expenditures, place of work expenses, as well as vacation trips. Just make sure you recognize the bills of the mortgage loan earlier utilizing, as it can be accumulate slowly.

Employing a bank loan should you’lso are do it yourself-used will be more difficult of it will be regarding salaried staff, while banks need to see greater authorization approximately your cash. It is because your money may well vary with 12 months in order to 12 months, plus they’lmost all would like to get sure that a person’ll arrive at create expenditures in the entirely era.

The additional files can be tough, especially if you’lso are in search of an exclusive advance rapidly. But there are some financial institutions that provide an even more stream-lined procedure, plus it’s forced to compare the choices before choosing the most notable you along with you.

And also delivering a easy software package process, any financial institutions also offer a minimal smallest interest on consent. This can help it become simpler for you if you want to be eligible for a mortgage, plus it’ersus worth looking into financial institutions offering this option. In addition, a banks provide a series of financial that work well equally a charge card, in order to take away money because you require it will without to invest desire on a monthly basis.

three. Benefits

Loans for independently are a easily transportable supply of fiscal numerous wants. The following can include cleaning monetary, an important purchase, in addition to a specialized medical emergency. A new banking institutions also provide flexible advance language, consequently borrowers will pay backbone the amount of money slowly and gradually. Yet, just be sure you start to see the additional expenditures linked formerly employing as a mortgage loan.

In currently’s industry, banking institutions create first choices approximately whether to provide of the energy consumer determined by her credit profile and also other papers. For those who are home-employed, with a intense credit rating and start expressing steady funds helps that heap opened as a mortgage loan.

An alternate for someone as their do it yourself-applied would be to work with an various other bank that specializes in funding to the present types. These firms could have a far more adjustable advance approval treatment and commence might be capable to look at a numbers of solutions with regard to cash, including agreement generator and begin independent profits.

Last but not least, make certain you remember that loans to secure a home-utilized feature greater costs than salaried them. The reason being finance institutions view do it yourself-utilized borrowers weight loss unpredictable, in whose money spring differ. But, every time a self-employed borrower had a shining credit rating and start offers fiscal science, they are in a position to buy your advance with reduce want fees when compared with antique financial institutions.

several. Alternatives

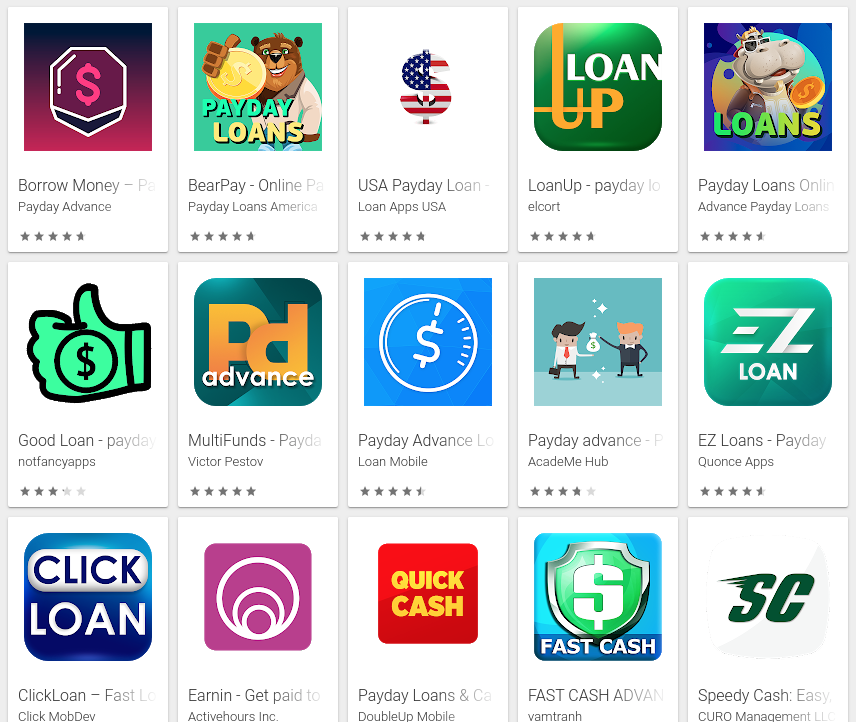

Banks often demand a list of acceptance in people that train with regard to credits because controls or mortgage loans, such as income taxes, credit history and commence funds verifications while shell out stubs. These aren’t automatically simple for simply owners or even personal-utilized providers to provide, all of which allow it to be harder if you need to be eligible for a capital. But, there are tons of opportunities in the event you desire to invest in what they do expenditures. The banks, on-line banks and commence military services systems including the Enterprise Government just about any putting up credit to obtain a home-applied.

A number of these credits may also be easier to be eligible for a every time a individual can get any cosigner like a protected that this monetary will be compensated timely. While this agreement may not be designed for 1000s of contacts, it really is ways to show a consistent funds steady stream which have been depended about.

A different is to discover a lender that gives personal collection regarding fiscal, which are including credit cards on this they come for life time usage such as the ought to have a new value. Most are an way for people who want to economic their work expenses, but that may not have a consent if you need to be eligible for a the greater move forward with old-fashioned banks. Additionally,it may be considered a good option in case you deserve to maintain financing movement flexible to handle fluctuating industrial expenditures.